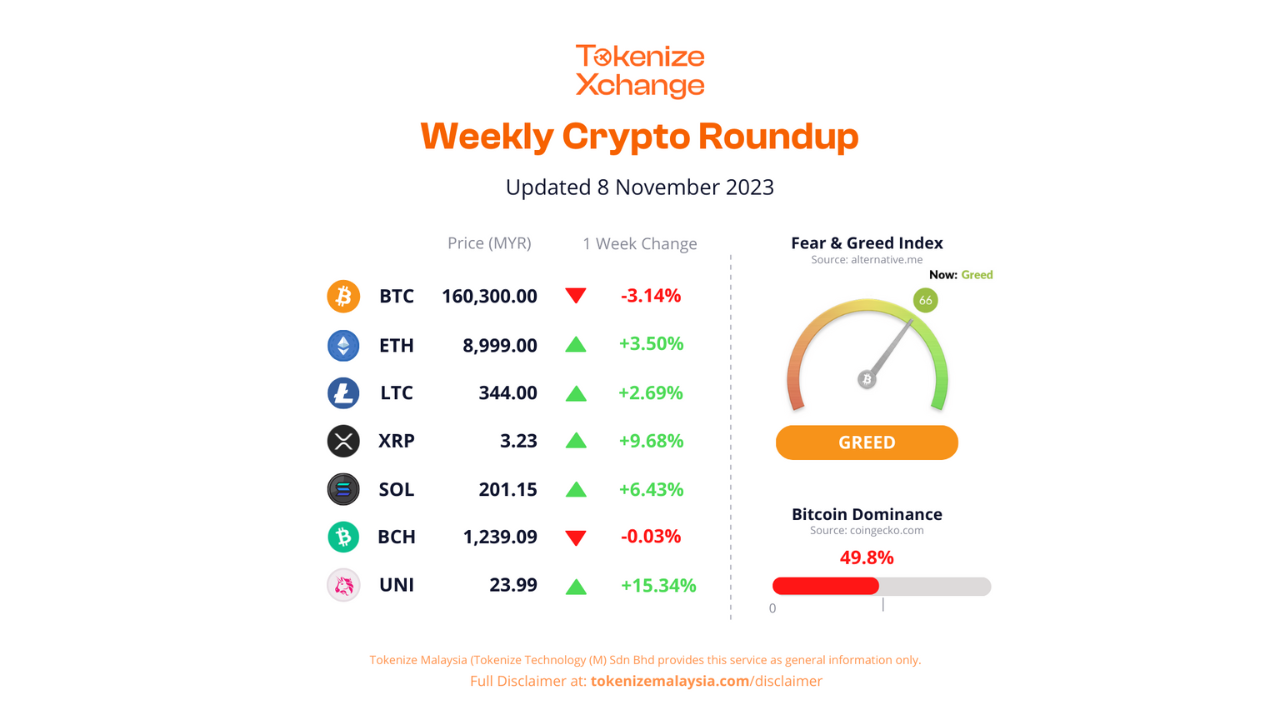

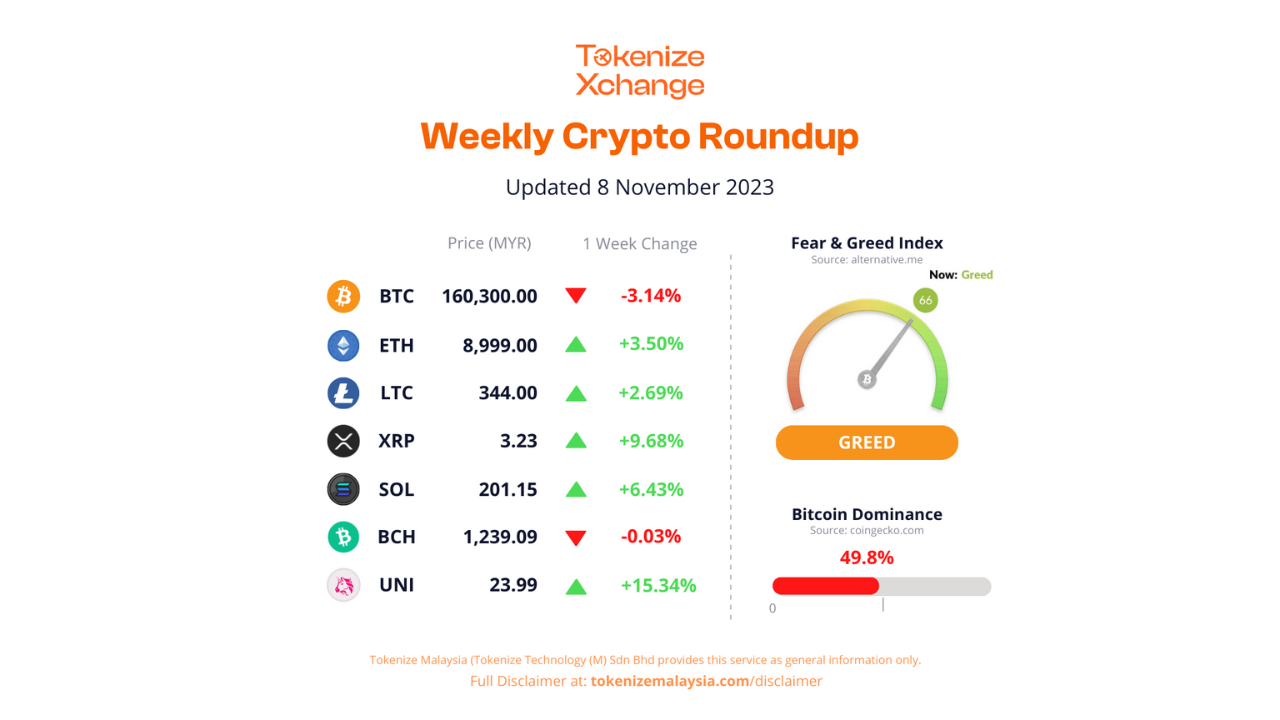

One remarkable feature of this period has been the resurgence of alternative cryptocurrencies. Notably, Ripple (XRP) and Uniswap (UNI) have emerged as standout performers, making substantial strides in price performance.

XRP’s impressive surge of over 11% in the past 24 hours has propelled it to become one of the top-performing cryptocurrencies, even as Bitcoin and Ethereum held steady. This surge can be attributed to two significant developments related to the company Ripple. Last week, Ripple secured crucial approvals to operate and offer its services in Georgia and Dubai. Notably, the Dubai Financial Services Authority (DFSA) gave its approval for XRP under its virtual assets regime, allowing licensed firms in the Dubai International Financial Centre to incorporate and offer XRP to clients as part of their crypto services. Additionally, Ripple announced its collaboration with the National Bank of Georgia (NBG) on the Digital Lari (GEL) pilot project, utilizing Ripple’s central bank digital currency (CBDC) platform. This platform, which is already in use by the Hong Kong and Taiwan governments, enables institutions to manage the entire lifecycle of CBDC, including minting, distribution, redemption, and token burning.

Simultaneously, Uniswap experienced a robust 15% increase in its prices over the same period. The surge can be attributed to the Uniswap DAO’s strategic investment of $12 million in the Ekubo Protocol, which secured a substantial 20% share of governance tokens. This move bolstered investor confidence in Uniswap’s long-term potential.

These developments reflect the dynamic nature of the cryptocurrency market, as investors pivot towards riskier assets and explore alternative tokens. Bitcoin’s declining dominance, now standing at 48.9%, has become a clear sign of this evolving investor sentiment, suggesting a riskier market stance and potentially marking the early stages of what some have termed an “altcoin season.” As the market continues to adapt, these developments exemplify the profound impact of regulatory approvals and strategic investments in reshaping the cryptocurrency landscape.