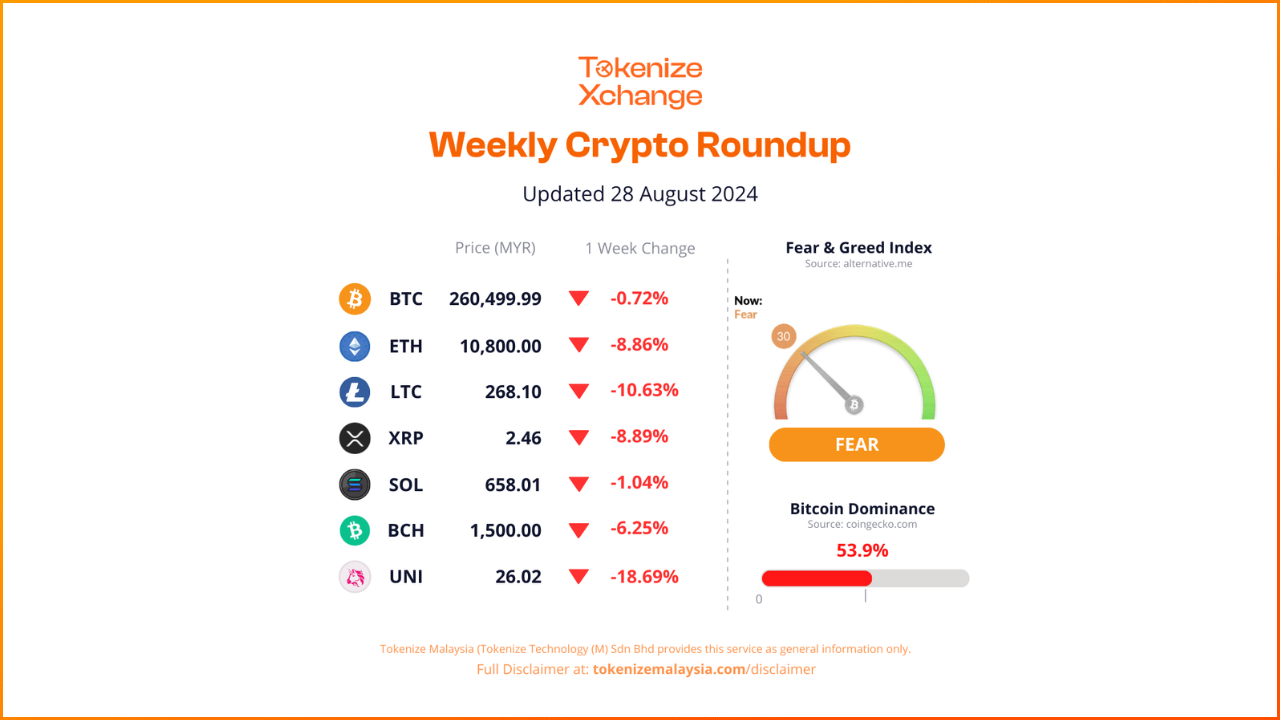

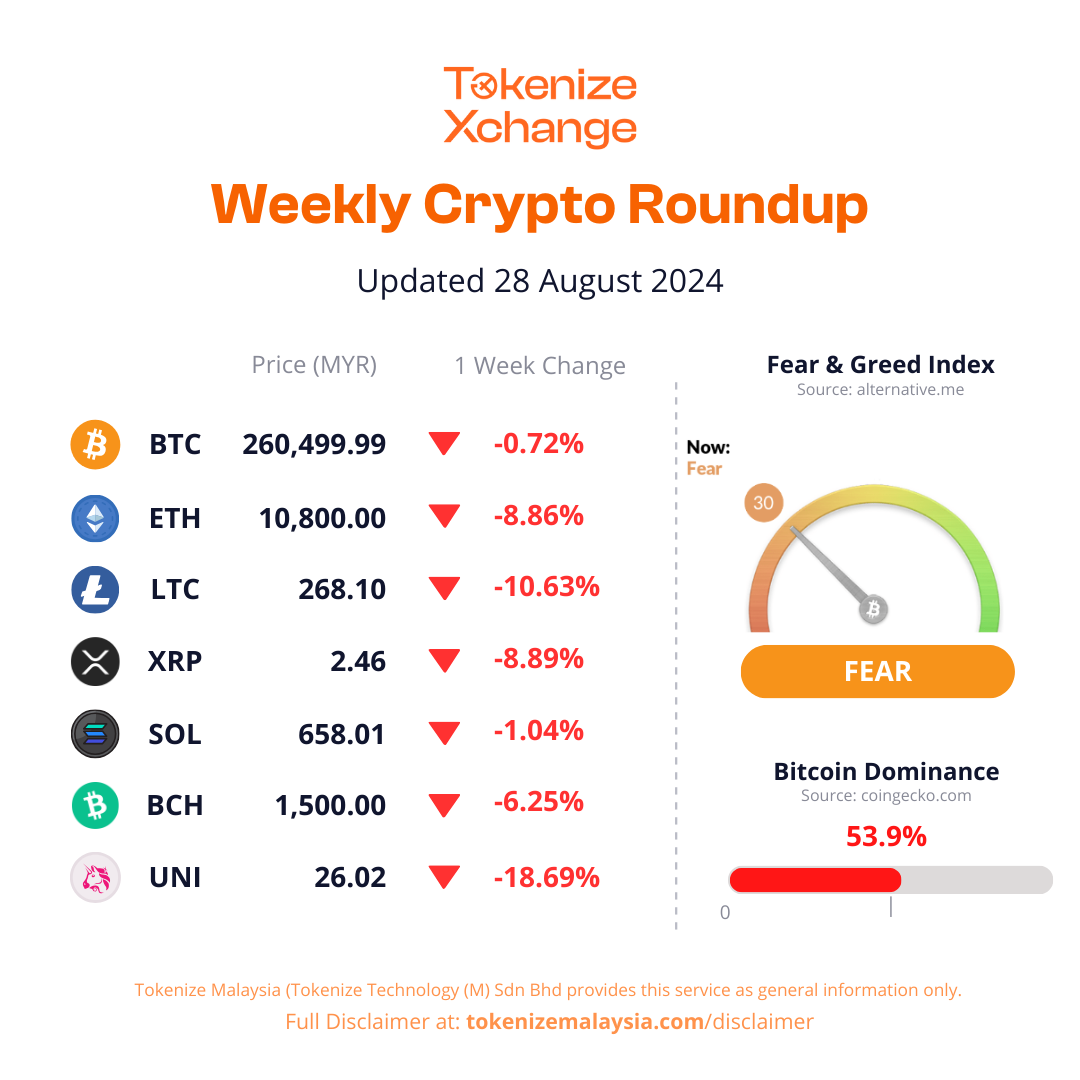

This week, the cryptocurrency market experienced a broad sell-off, with most major assets recording losses. Bitcoin (BTC) declined by 0.72%, partly due to the liquidation of long positions and uncertainty surrounding potential interest rate hikes, as reported by Bloomberg. Ethereum (ETH) faced a sharper drop of 8.86%, driven by fading momentum from recent ETF launches and concerns about network scalability, according to CoinTelegraph. Litecoin (LTC) and XRP (XRP) faced sharper declines of 10.63% and 8.89%, respectively. Litecoin’s (LTC) drop comes despite the upcoming halving event, which typically sparks price increases, indicating market uncertainty or sell-off pressure. On the other hand, XRP’s decline is largely attributed to ongoing legal challenges in the U.S. despite its recent partial victory against the SEC, with uncertainty over future regulatory clarity weighing on investor sentiment, as noted by Bloomberg. Solana’s (SOL) 1.04% dip was mitigated by ongoing network upgrades, which helped maintain some investor confidence. Meanwhile, Bitcoin Cash (BCH) and Uniswap (UNI) saw declines of 6.25% and 18.69%, respectively, with Uniswap (UNI) being particularly affected by increased competition in the decentralized finance (DeFi) space, as noted by The Block. These movements reflect a cautious market environment, with investors reacting to both macroeconomic pressures and sector-specific developments.

#WeeklyCryptoRoundup #MarketNews #TokenizeMalaysia