Introduction to Curve DAO Token (CRV)

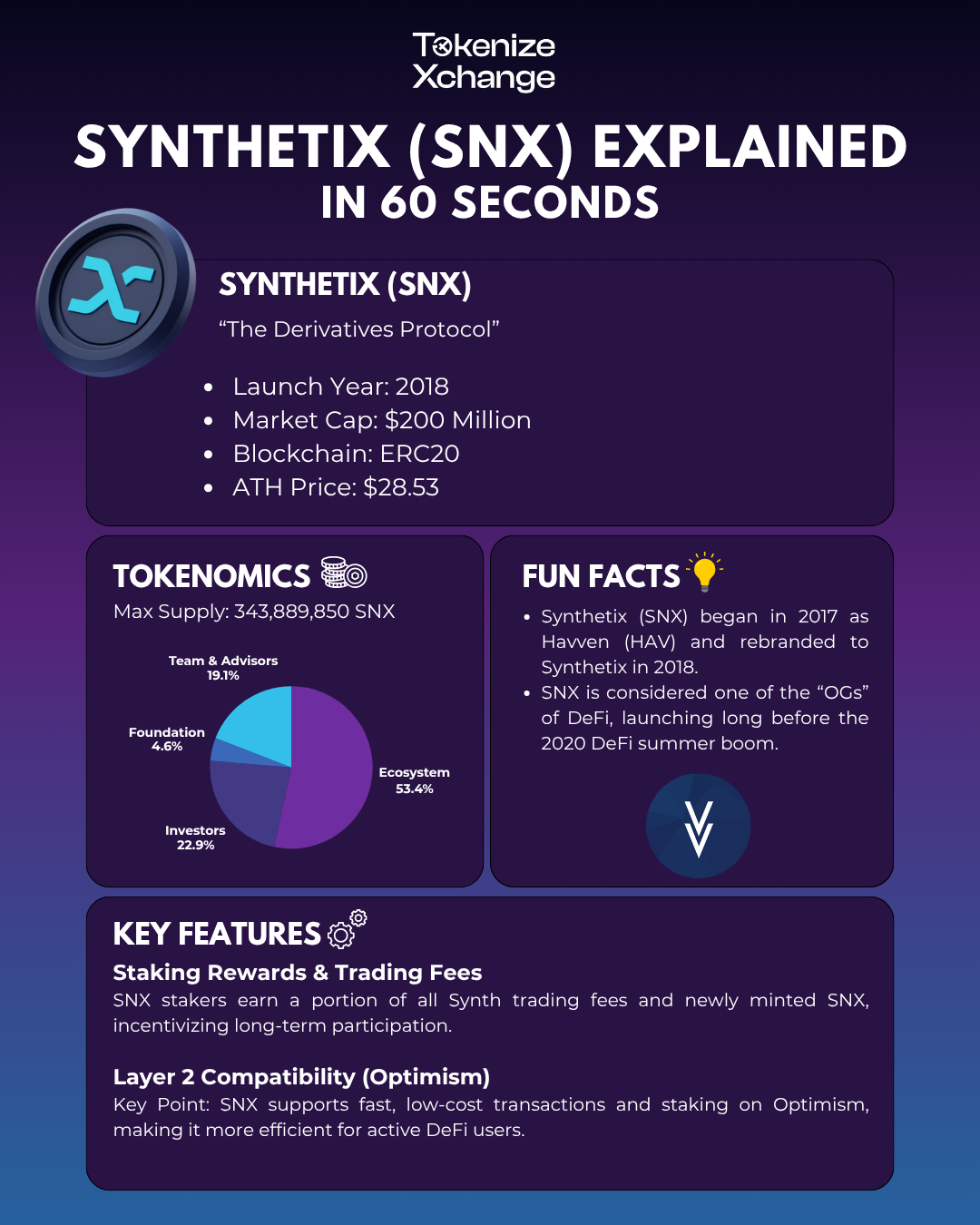

Synthetix (SNX) is a decentralized liquidity protocol that enables the creation and trading of synthetic assets. Originally launched as Havven (HAV) in 2017, the project rebranded to Synthetix in 2018. As one of the early pioneers in the DeFi space, SNX is considered one of the “OGs” of DeFi, having established itself well before the DeFi summer boom of 2020. Synthetix aims to bring deep, permissionless liquidity to the derivatives market, offering users exposure to a wide range of assets without holding the underlying collateral.

Key Stats at a Glance

- Launch Year: 2018

- Market Cap: $200 Million

- All-Time High (ATH) Price: $28.54

- Blockchain: Ethereum (ERC20)

- Token Ticker: SNX

Key Features

Synthetix offers powerful incentives for token holders through its staking and fee-sharing model. By staking SNX, users help collateralize synthetic assets (Synths) and, in return, earn a share of all trading fees generated on the platform, as well as newly minted SNX. This mechanism encourages long-term commitment and active participation in maintaining the protocol’s liquidity. In addition, Synthetix supports Layer 2 compatibility via Optimism, significantly reducing gas fees and enabling faster transaction speeds. This integration enhances the staking and trading experience for users, making the platform more scalable and efficient for everyday DeFi activity.

Tokenomics and Distribution

SNX has a capped total supply of 308 million tokens. The protocol uses inflationary rewards to incentivize staking, with emissions gradually tapering over time. A large portion of the token distribution supports protocol development, community initiatives, and long-term staking incentives.

- Ecosystem – 53.4%

- Investors – 22.9%

- Foundation – 4.6%

- Team & Advisors – 19.1%

Conclusion

Synthetix (SNX) is a foundational project in the decentralized finance space, offering users synthetic exposure to a broad range of assets with no central intermediaries. With staking incentives, cross-chain functionality, and integration with Layer 2 solutions like Optimism, SNX continues to evolve as a key player in DeFi’s infrastructure. As the demand for decentralized derivatives grows, Synthetix is positioned to remain a powerful protocol for synthetic asset trading and liquidity.