Cryptocurrency has gained popularity in Malaysia as an alternative investment, but many investors are still unsure about the tax implications of their crypto transactions. In this article, we will look at some main highlights in the guidelines on the tax treatment of digital currency transactions published by the Inland Revenue Board of Malaysia (LHDN). It is essential for investors to keep informed of what is taxable and what is not when it comes to cryptocurrency investment in Malaysia.

Taxable Crypto Transactions

According to LHDN, active trading, the business of mining crypto, salary paid in crypto, and accepting crypto for goods and services are considered taxable crypto transactions.

- Active trading refers to regular trading with the intent to earn a profit, and profits gained from trading are considered taxable income under Section 3 of the Income Tax Act 1967.

- If you are a crypto miner, the income derived from mining activities is also taxable.

- If you receive your salary in cryptocurrency, it is treated as taxable income, and your employer is required to deduct the appropriate tax amount.

- If you are a merchant who accepts cryptocurrency for goods and services, you must declare the value of the cryptocurrency received as part of your business income. The value of the cryptocurrency received is determined based on the prevailing market rate at the time of the transaction.

Non-Taxable Crypto Transactions

Investing and buying cryptocurrency for transactions are considered non-taxable crypto transactions.

- Investors who hold cryptocurrency as a long-term investment and do not trade regularly may view any profits made as capital gains, which are not taxable in Malaysia.

- If you receive free cryptocurrency from an airdrop, it is not taxable as there is no monetary consideration given.

- Similarly, if you purchase cryptocurrency for personal transactions, such as paying for goods and services, it is not considered a taxable transaction.

Preparing for Crypto Taxation

It’s important for investors to keep a record of their cryptocurrency transactions as a precaution. This will help to ensure that you are able to accurately report your taxable income when required.

If you are unsure about the tax implications of your crypto transactions, it’s always a good idea to consult a tax accountant. A tax accountant will be able to provide you with a suitable course of action based on your specific circumstances and ensure that you are compliant with Malaysian tax laws.

In conclusion, investors should stay informed about any new developments in the space and be prepared for any changes in the tax treatment of their crypto transactions. It is important for investors to understand the tax implications of their crypto transactions. By keeping accurate records of the transactions and seeking the advice of a tax accountant, investors can ensure that they remain compliant with Malaysian tax laws and avoid any potential penalties that may arise.

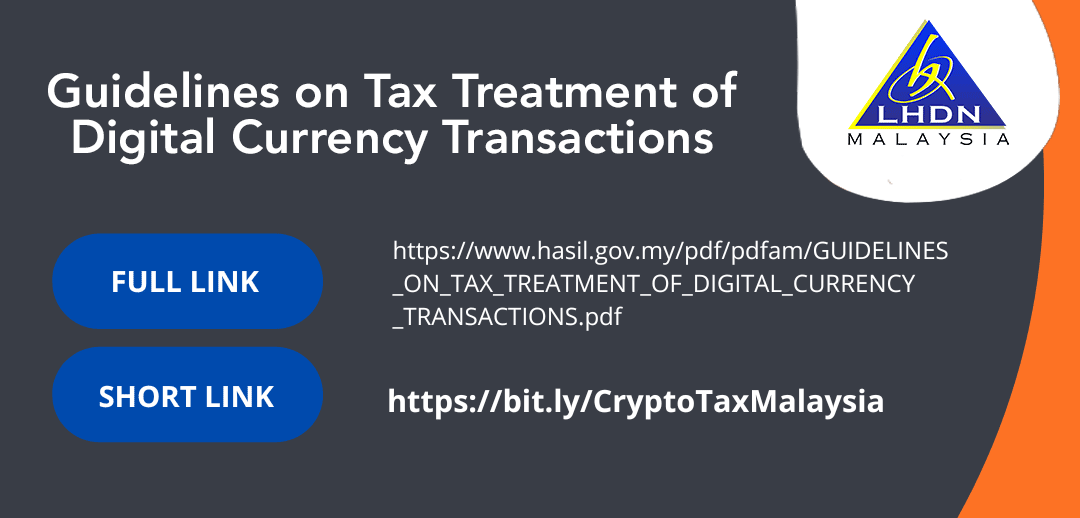

The Inland Revenue Board of Malaysia (LHDN) has previously published their guidelines on the Tax Treatment of Digital Currency Transactions and there are several highlights that we can take note of. You can follow this link to read the full guideline document.