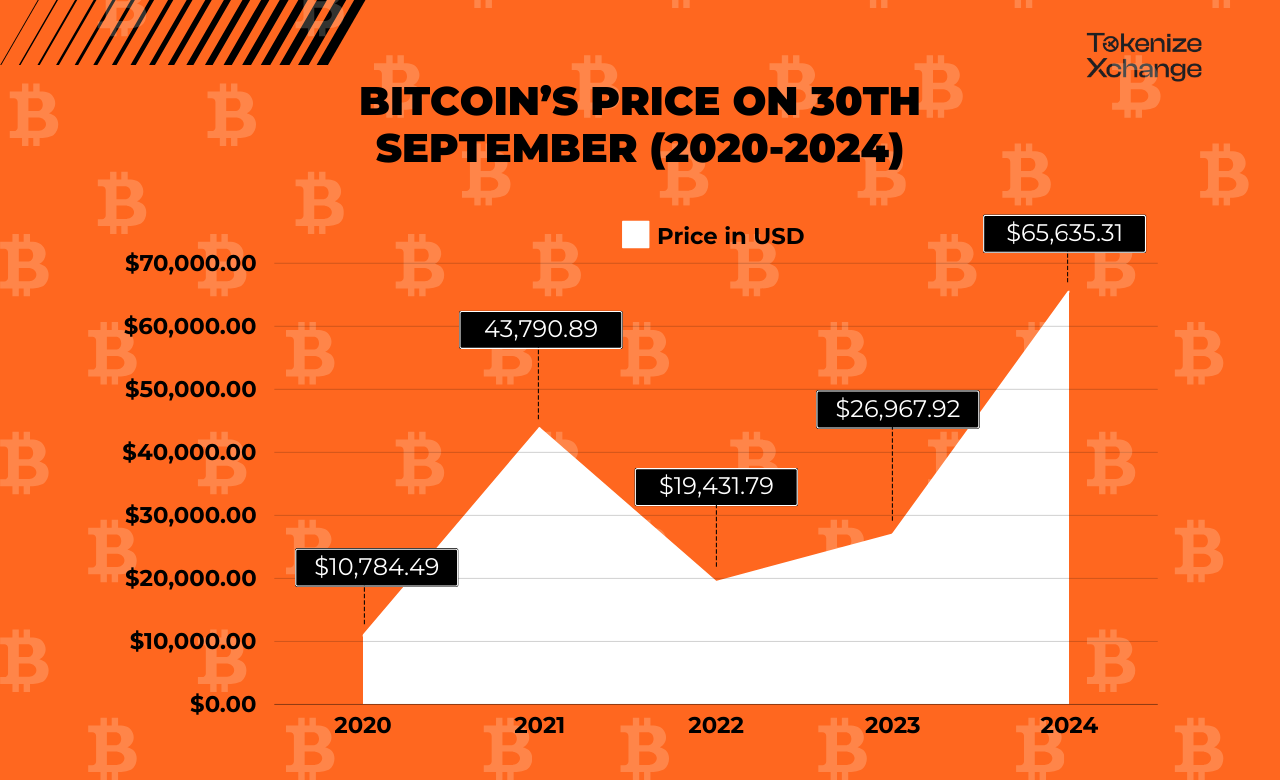

Bitcoin, the world’s leading cryptocurrency, has seen tremendous price fluctuations over the years, with every year offering a unique set of challenges and triumphs for traders and investors alike. As we reflect on Bitcoin’s performance on September 30th each year, from 2020 to 2024, we can see how this digital asset has evolved in value, driven by market sentiment, macroeconomic trends, and growing institutional interest.

2020: A Steady Foundation

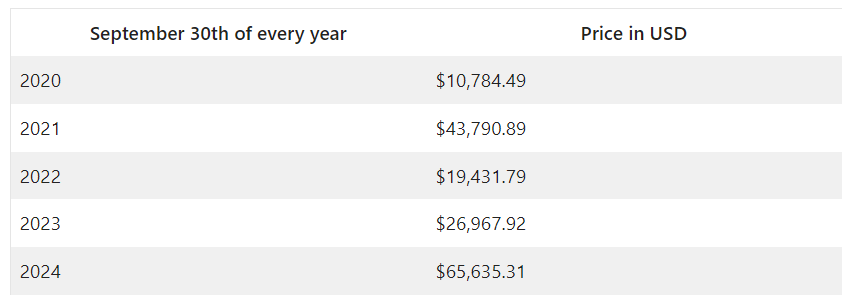

Price on September 30, 2020: $10,784.49

The year 2020 marked a critical turning point for Bitcoin. After years of gradual growth, Bitcoin found itself in the spotlight as the world grappled with the COVID-19 pandemic. Investors began to see Bitcoin as a hedge against inflation and economic uncertainty. By the end of September 2020, Bitcoin was trading at $10,784.49—a steady, yet relatively modest figure compared to its future valuations. This period laid the foundation for a bullish rally in the following year.

2021: The Bull Run

Price on September 30, 2021: $43,790.89

2021 was a landmark year for Bitcoin, characterized by a massive bull run that catapulted its price to new heights. The cryptocurrency soared to $43,790.89 by the end of September, as institutional investors, companies, and even governments started to embrace Bitcoin. Key events like Tesla’s Bitcoin investment and the introduction of Bitcoin ETFs played major roles in boosting demand. This was also the year El Salvador became the first country to adopt Bitcoin as legal tender, further cementing Bitcoin’s place on the global stage.

2022: The Market Correction

Price on September 30, 2022: $19,431.79

After an explosive 2021, Bitcoin faced a significant market correction in 2022. The cryptocurrency dropped to $19,431.79 by September 30th, largely due to global economic pressures, rising inflation, and tightening monetary policies. The collapse of key crypto projects, such as Terra/Luna, and regulatory uncertainty also contributed to Bitcoin’s decline. This period marked a cooling-off phase as investors reconsidered their positions in the digital asset space.

2023: Recovery in Motion

Price on September 30, 2023: $26,967.92

Despite the turbulence of 2022, Bitcoin showed signs of recovery in 2023. By the end of September, Bitcoin climbed back to $26,967.92. Renewed optimism was driven by a combination of easing inflation, the anticipation of Bitcoin halving (scheduled for 2024), and an increase in institutional investment. While volatility remained a key feature of the market, Bitcoin’s resilience kept investors hopeful for another long-term upward trend.

2024: A New Peak

Price on September 30, 2024: $65,635.31

2024 stands out as the year Bitcoin broke its previous all-time highs, reaching a staggering $65,635.31 by September 30th. This dramatic surge in price was largely attributed to Bitcoin’s fourth halving event earlier in the year, reducing the block reward and increasing scarcity. Additionally, the broader acceptance of Bitcoin as a store of value and increased adoption by financial institutions pushed the price to unprecedented levels. The world began to see Bitcoin not just as a speculative asset, but as a crucial component of the future global financial system.

Conclusion: A Rollercoaster Ride

The price of Bitcoin from 2020 to 2024 showcases its inherent volatility and potential for growth. While Bitcoin faced challenges in 2022 with a major correction, it rebounded stronger than ever by 2024, reinforcing its position as a leading asset in the digital economy. Whether Bitcoin’s journey continues to reach new highs or faces more corrections, one thing remains clear—Bitcoin has solidified its role as a significant financial asset with far-reaching global implications.