Whether you’re buying Bitcoin, Ethereum, or any other digital asset, understanding how you place your trade is just as important as what you’re trading. In crypto (and other markets), two of the most common order types are Market Orders and Limit Orders.

Each serves a different purpose — and knowing when to use which can make all the difference in your trading journey.

What is a Market Order?

A Market Order is the most straightforward way to buy or sell crypto. When you place a market order, you’re asking the system to execute the trade immediately at the best price currently available.

✅ Pros of Market Orders

1. Instant Execution

No waiting. Your order is processed the moment you place it. Ideal for when you need to act fast — like in response to breaking news or sudden price spikes.

2. Simple to Use

You don’t need to worry about setting a price or timing the market. This simplicity makes Market Orders the preferred choice for first-time traders.

❌ Cons of Market Orders

1. Price Slippage

You’re at the mercy of the current market price. If it shifts while your trade is being executed, you could end up paying more than you planned or selling for less.

2. No Price Control

During periods of high volatility, prices can change within seconds. A Market Order may be filled at a less favourable price than expected.

What is a Limit Order?

A Limit Order lets you set the exact price at which you’re willing to buy or sell. The order is only executed if the market reaches your target price — no sooner, no later.

✅ Pros of Limit Orders

1. No Slippage

You specify the exact price you’re comfortable with. If the market doesn’t meet your terms, your order won’t go through — which protects you from overpaying or underselling.

2. Full Control Over Price

You control the exact price at which the trade occurs which allows you to setup trades in advance

❌ Limitations of Limit Orders

1. Slower Execution

Limit Orders may take minutes, hours, or days to execute — or may never fill at all.

2. Requires Monitoring

You may need to adjust your order if market conditions change, particularly in volatile markets.

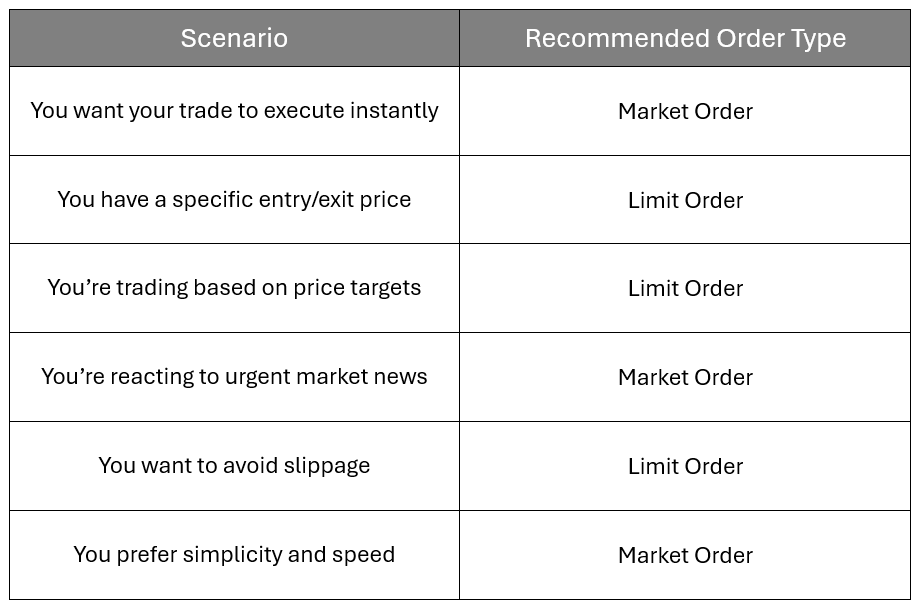

Which Order Type Should You Use?

Choosing between a Market Order and a Limit Order often depends on your trading goals and the current market situation. Here’s a quick reference to help you decide:

Final Thoughts

Both Market and Limit Orders serve different purposes in a trader’s toolkit.

- Market Orders prioritize speed and simplicity.

- Limit Orders prioritize control and precision.

Choosing the right one depends on your trading objectives, strategy, and risk appetite.