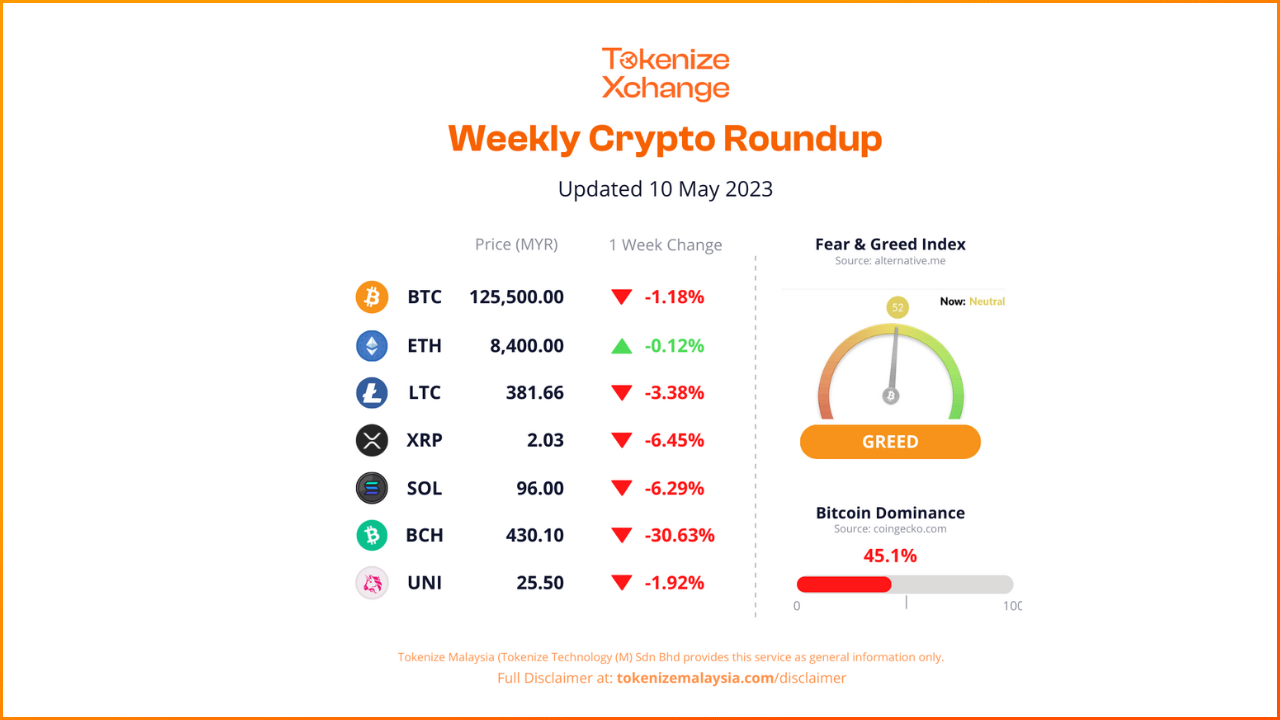

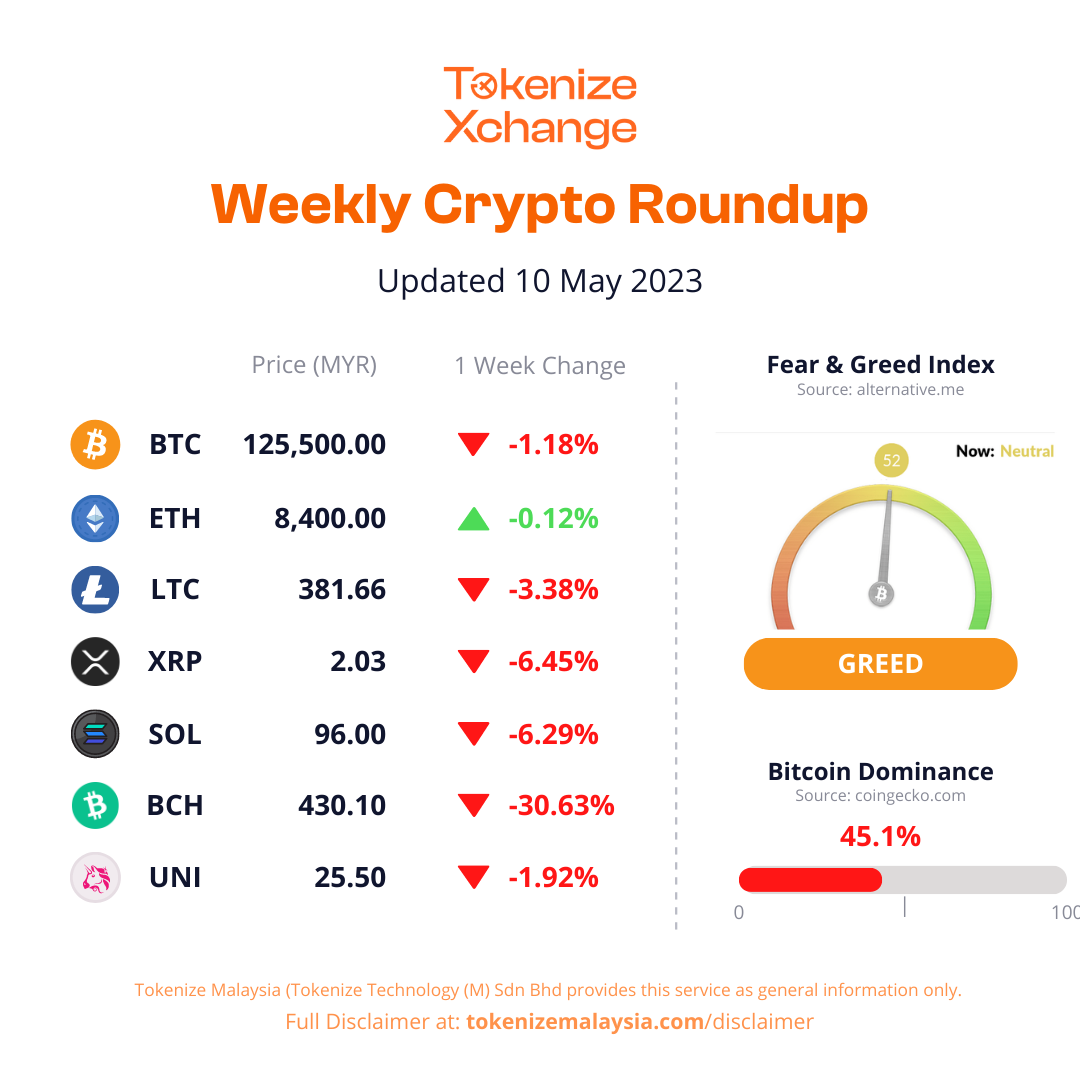

The cryptocurrency market has recently experienced a dip in overall prices and market capitalization. Despite this, the Bitcoin fear & greed index remains relatively neutral, hovering around 52. This index is a measure of investor sentiment and can indicate whether the market is driven by fear or greed. In this case, the neutral reading suggests a balanced sentiment among investors.

Meanwhile, Bitcoin Cash (BCH) has shown signs of stability after a previous rally. Following a period of increased demand and price appreciation, BCH has entered a phase of correction and consolidation. This stability indicates a potential equilibrium between buyers and sellers in the market, as investors reassess their positions.

On the other hand, Ripple (XRP) has faced significant challenges in the form of ongoing legal disputes with the U.S. Securities and Exchange Commission (SEC). As a result, Ripple’s price has fallen by 6.29% compared to the previous week. The legal hurdles have introduced uncertainty into Ripple’s future, leading some investors to sell off their holdings.

It’s important to note that the cryptocurrency market is highly volatile, and fluctuations in prices can occur due to various factors such as market sentiment, regulatory actions, and technological developments. Investors and market participants should closely monitor the situation and consider the potential impacts of legal proceedings on Ripple’s performance.