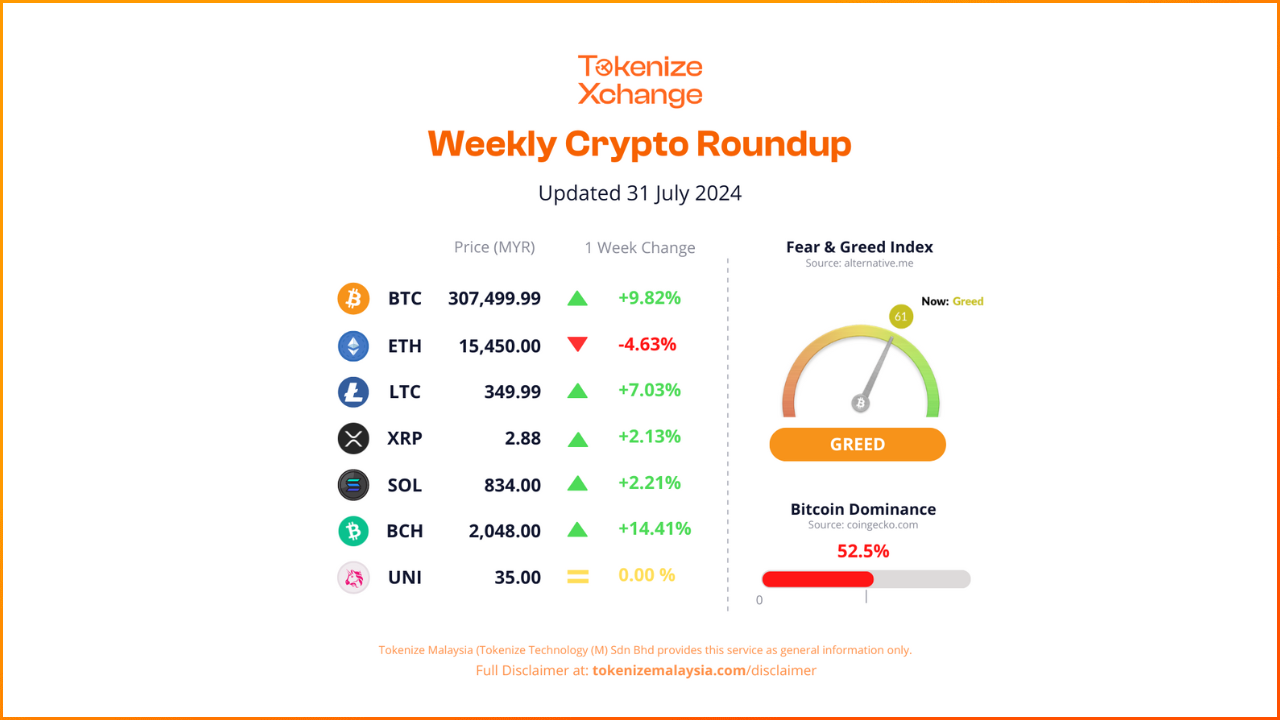

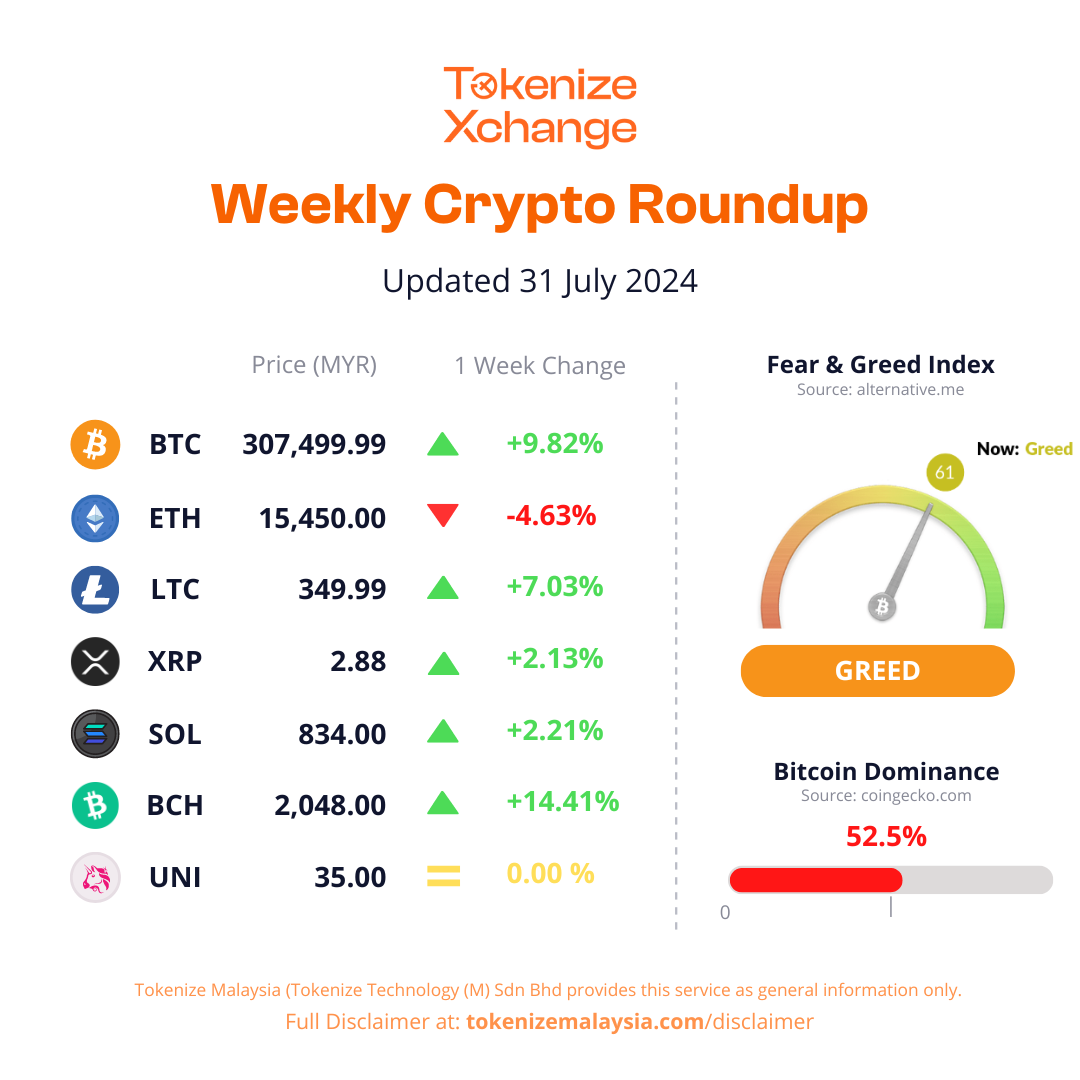

This week, the cryptocurrency market saw varied price changes. Notably, Ethereum (ETH) declined by 4.63% as the decline occurred despite significant inflows into Ethereum ETFs, which saw $2.2 billion in new investments, the largest since December 2020. CoinShares reported that digital asset investment products experienced net inflows of $245 million last week, with trading volumes for exchange-traded products (ETPs) reaching $14.8 billion, thanks to the launch of spot Ethereum ETFs in the US. However, the inflows were offset by substantial outflows from Grayscale’s existing Ethereum trust, leading to a net outflow of $285 million. Meanwhile, Bitcoin Cash (BCH) surged by 14.41%, driven by significant market momentum and increased investor engagement. This uptick was influenced by Donald Trump’s announcement of a strategic Bitcoin reserve, which likely boosted interest in Bitcoin Cash as well. The active trading dynamics around Bitcoin Cash and other related assets reflect a heightened market interest in cryptocurrencies with “Bitcoin” in their name. The market movements this week have been influenced by a combination of technological advancements and and specific asset-related news.