With the rise of cryptocurrencies, many people are looking for safe and convenient ways to withdraw their assets as cash.

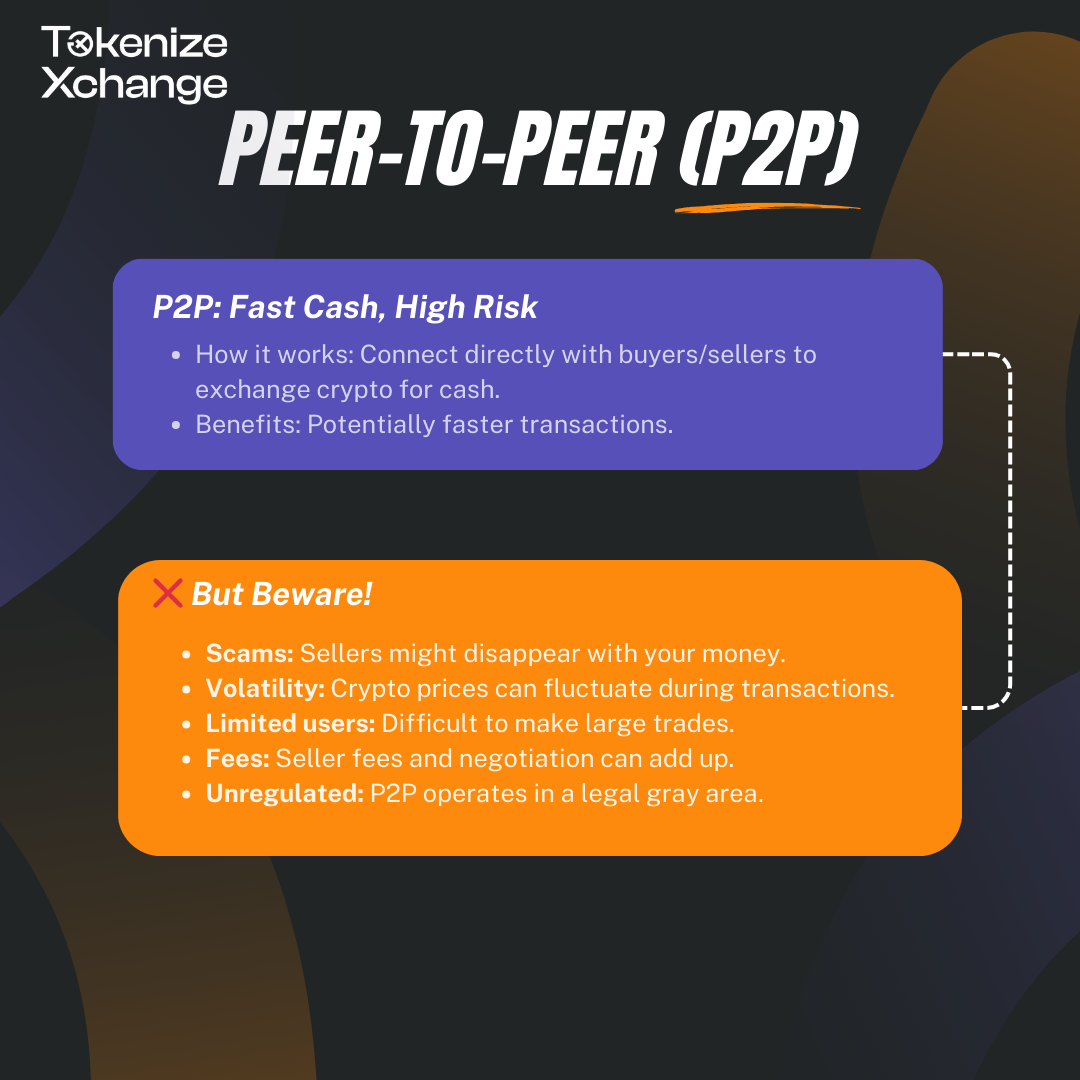

P2P: Fast Cash, High Risk

P2P transactions allow you to connect directly with buyers or sellers to exchange your cryptocurrency for cash. While this method offers potentially faster transactions, it comes with significant risks:

- Fraud and Scams: There’s a high chance of sellers taking your money and disappearing.

- Volatility: Cryptocurrency prices can fluctuate dramatically during transactions, leading to losses.

- Regulation: P2P transactions often operate in a legal gray area, increasing the risk of violating financial regulations.

- Slow Speeds and Low Liquidity: Transactions can stall due to delays or cancellations, and limited users may restrict large trades.

- Higher Costs: Seller fees and negotiation can add up significantly.

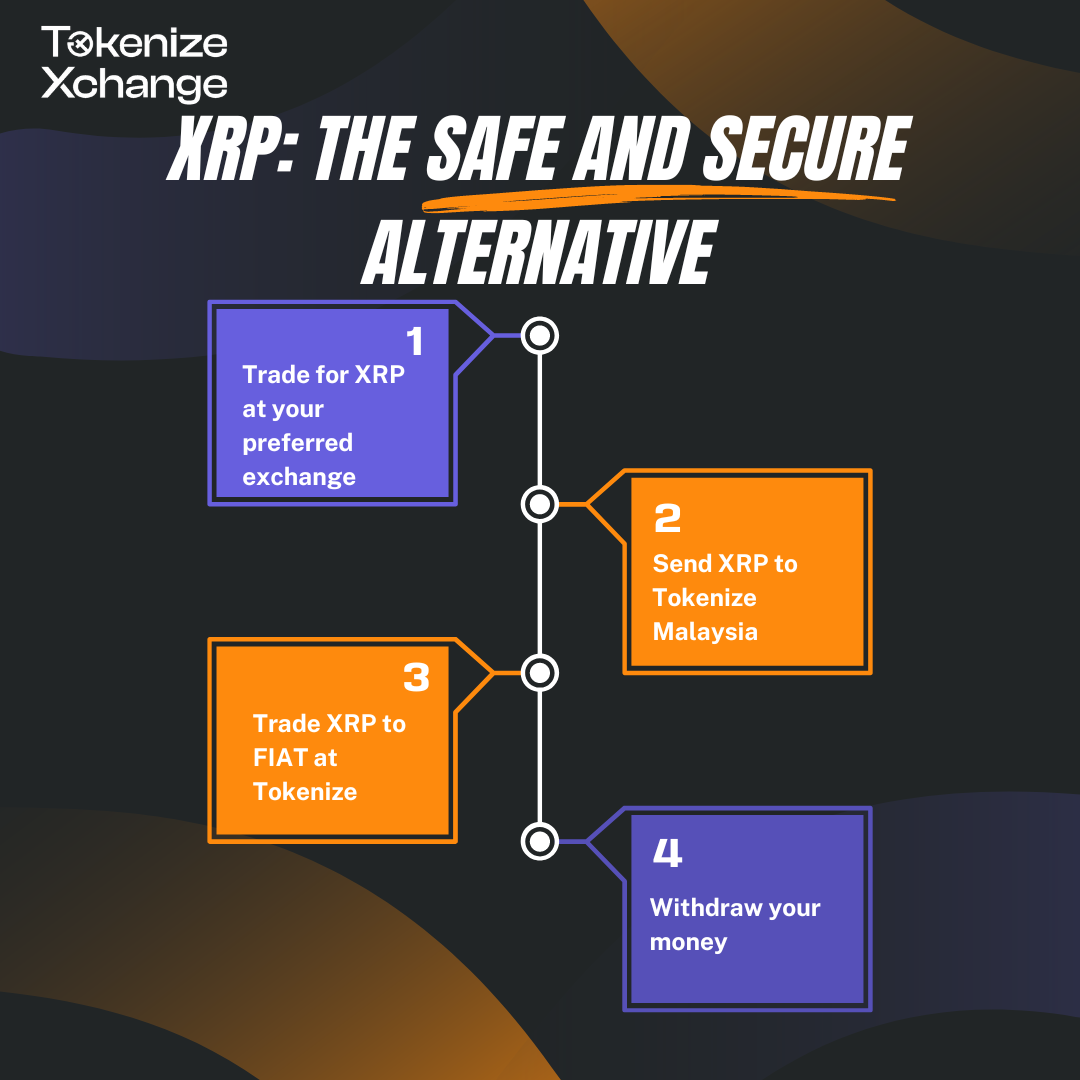

XRP: A Secure Alternative for Crypto Withdrawal

XRP offers a more secure alternative for withdrawing your cryptocurrency assets. Here’s why:

- Regulated Exchanges: Look for reputable, regulated cryptocurrency exchanges that support XRP withdrawals. These platforms adhere to strict security protocols and financial regulations, protecting your assets.

- Simple Withdrawal Process: Most exchanges offer a straightforward withdrawal process. You’ll typically initiate the withdrawal, send your XRP to the exchange’s wallet address, and receive your cash after verification.

- Faster Transactions: XRP transactions are known for their speed and efficiency, meaning you can access your cash quicker.

Choosing the Right Option

While P2P offers potentially faster transactions, the associated risks are significant. For a safer and more secure withdrawal experience, consider using XRP on a reputable, regulated exchange. This approach provides peace of mind with faster transaction times compared to traditional banking methods.